Income Tax Brackets 2025 Vs 2025

Income Tax Brackets 2025 Vs 2025. The tax inflation adjustments for 2025 rose by 5.4% from 2023 (which is slightly lower than the 7.1% increase the 2023 tax year had over the 2022 rates). There are seven tax brackets for most ordinary income for the 2023 tax year:

On january 1, 2025, georgia transitions from a graduated individual income tax with a top rate of 5.75 percent to a flat tax with a rate of 5.49 percent. 10%, 12%, 22%, 24%, 32%, 35% and 37%.

The Federal Federal Allowance For Over 65 Years Of Age Married (Joint) Filer In 2025 Is $.

The federal standard deduction for a married (joint) filer in 2025 is $ 29,200.00.

Here Is A List Of Our Partners And Here's How We Make Money.

10%, 12%, 22%, 24%, 32%, 35%, and 37%.

For Example, Assume A Hypothetical Taxpayer Who Is Married With $150,000 Of Joint Income In 2025 And Claiming The Standard Deduction Of $29,200.

Images References :

Source: forum.bodybuilding.com

Source: forum.bodybuilding.com

IRS Here are the new tax brackets for 2023, The finance minister made changes in the income tax slabs under the new tax regime. 20% of the total income + rs.10,500 + 4% cess.

Source: www.linkedin.com

Source: www.linkedin.com

Understanding 2023 Tax Brackets What You Need To Know, Use our tax bracket calculator to understand what tax bracket you're in for. The tax inflation adjustments for 2025 rose by 5.4% from 2023 (which is slightly lower than the 7.1% increase the 2023 tax year had over the 2022 rates).

Source: taxedright.com

Source: taxedright.com

IRS Inflation Adjustments Taxed Right, Your taxable income is your income after various deductions, credits, and exemptions have been. The tax items for tax year 2025 of greatest interest to most.

Source: www.humaninvesting.com

Source: www.humaninvesting.com

2022 tax updates and a refresh on how tax brackets work — Human Investing, You pay tax as a percentage of your income in layers called tax brackets. They remain at 10, 12, 22, 24, 32, 35, and 37 percent.

Source: chrissiewjeana.pages.dev

Source: chrissiewjeana.pages.dev

Federal Tax Deposit Requirements 2025 Election Nelia, 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Credits, deductions and income reported on other forms or schedules.

Here are the federal tax brackets for 2023 vs. 2022 Narrative News, The federal standard deduction for a married (joint) filer in 2025 is $ 29,200.00. These income thresholds are roughly 5.5% to 6% higher than those announced for the 2023 tax season, where the lowest rate was for single filers making $11,000 or less.

Source: thehill.com

Source: thehill.com

Tax filers can keep more money in 2023 as IRS shifts brackets The Hill, Your taxable income is your income after various deductions, credits, and exemptions have been. Income tax rates for fy.

Source: adiqjenine.pages.dev

Source: adiqjenine.pages.dev

Irs New Tax Brackets 2025 Elene Hedvige, Here is a list of our partners and here's how we make money. You pay tax as a percentage of your income in layers called tax brackets.

Source: www.newretirement.com

Source: www.newretirement.com

2026 Tax Brackets Why Your Taxes Are Likely to Increase in 2026 and, The basic difference between the old and new income tax regime is that the former allows for major. They remain at 10, 12, 22, 24, 32, 35, and 37 percent.

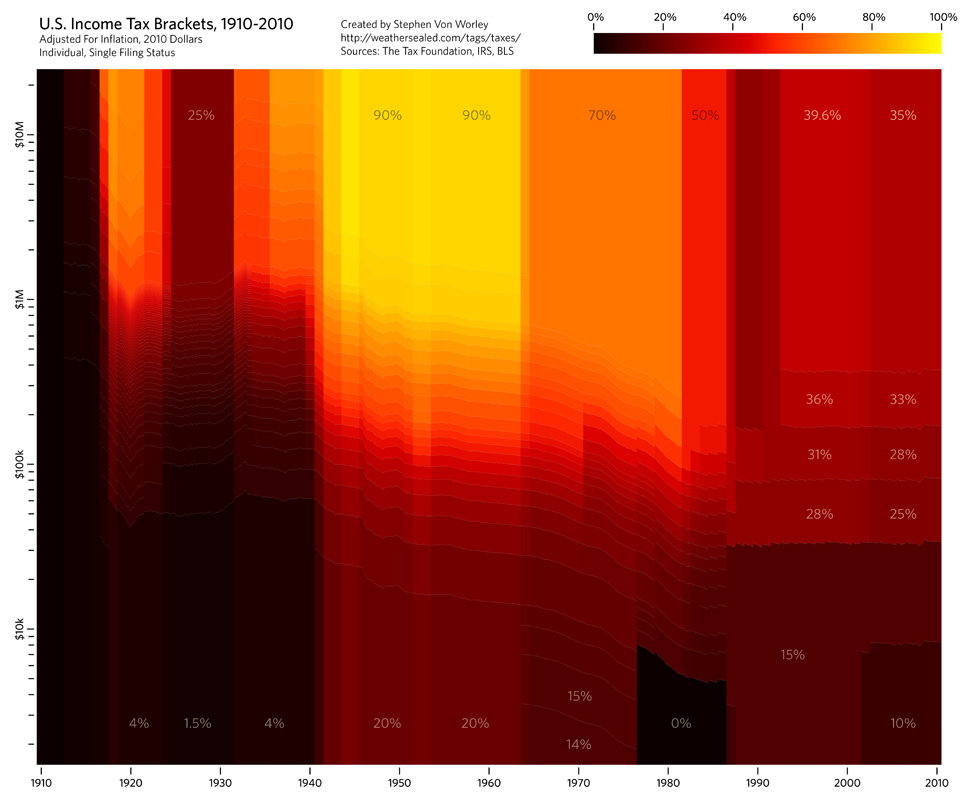

Source: flowingdata.com

Source: flowingdata.com

Tax brackets over the past century FlowingData, There are seven tax brackets for most ordinary income for the 2023 tax year: An australian resident for tax purposes for the full year;

For The Tax Year 2025, The Top Tax Rate Is 37% For Individual Single Taxpayers With Incomes Greater Than $609,350 ($731,200 For Married Couples Filing Jointly).

The tax inflation adjustments for 2025 rose by 5.4% from 2023 (which is slightly lower than the 7.1% increase the 2023 tax year had over the 2022 rates).

These Income Thresholds Are Roughly 5.5% To 6% Higher Than Those Announced For The 2023 Tax Season, Where The Lowest Rate Was For Single Filers Making $11,000 Or Less.

The finance minister made changes in the income tax slabs under the new tax regime.